Quickbooks For Mac Can't Download Transactions To Credit Card

- Quickbooks For Mac Can't Download Transactions To Credit Card 2016

- Quickbooks For Mac Can't Download Transactions To Credit Card Account

- Quickbooks For Mac Can't Download Transactions To Credit Card Free

Oct 04, 2019 I cant download bank transactions in my Quickbooks 2014 for Mac. I get the error 'recnum is too small' Install on - Answered by a verified Tech Support Rep. Dec 12, 2019 Some banks only allow downloads to Quicken after the statement closing date, meaning that you won't see new transactions in Quicken until the statement closes. If you can't select a date range when you try to download from your bank, it means that you're only able to download new transactions after the statement closing date.

Per usual trouble shooting, I de-activated downloads on both accounts. Now I cannot re-activate downloads on either one. If I edit either one of the accounts I get the error 'Retry. Temproary Issue with the FI.Login response. Kindly retry.. ccscrape.102'

If I try and create a new account, I get the error 'Quicken encountered an error while communicating with our servers.'

Any advice, before I go to chat support? I am worried they'll tell me to export the file and read it back in, which the last time I had to do it deleted a lot of category detail, so I'd rather not if there's any other way.

Thank you.

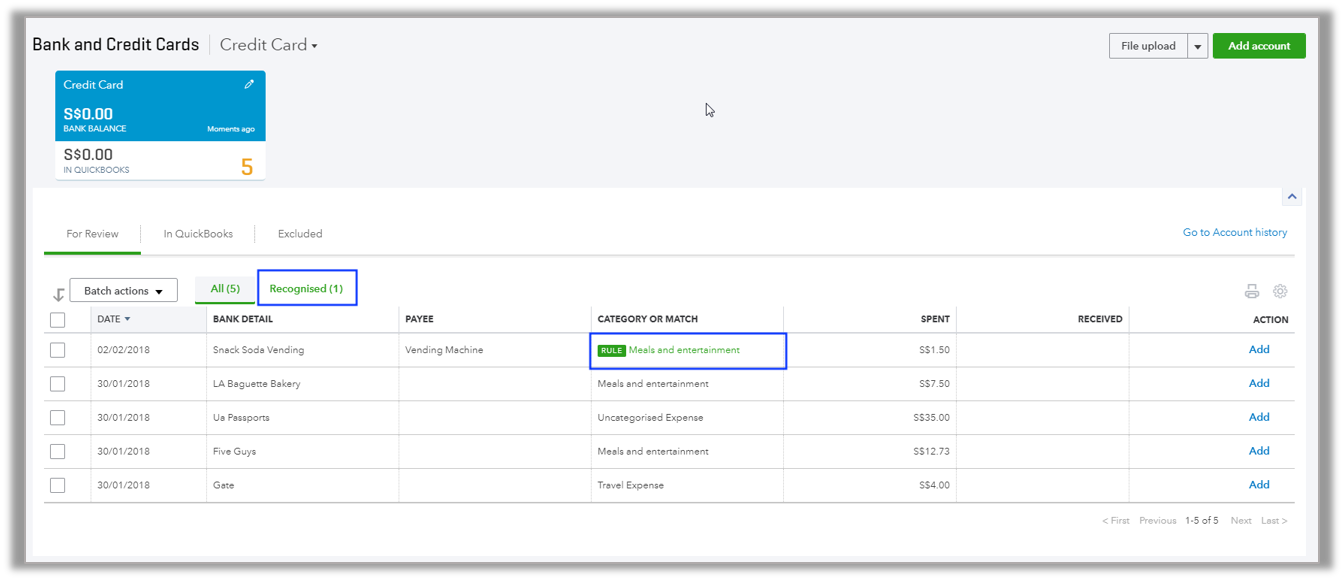

Bank Feed Errors in QuickBooks Online (and How to Fix Them): Part 1 Bank Feed Stops Syncing. One of the most dynamic features of QuickBooks Online is the Bank Feed. This feature connects your online bank and credit card accounts to QuickBooks and feeds. Once your new transactions have downloaded, you will need to review and manually delete any duplicate or credit transactions. How do I download my account information into QuickBooks? The first step is to register your Discover card account online if you have not already. Jul 25, 2019 When to Manually Enter Business Credit Card Transactions in QuickBooks Online. If your financial institution doesn’t integrate with QuickBooks and you can’t obtain a CSV file with your banking transactions, you have to manually enter credit card transactions in QuickBooks.

Comments

- edited May 2018I have Citi also but is set up for web connect vice direct. As of this writing I was able download transactions without any issue using the web connect as I was checking to see if I had the same issue as Citi does make changes now and again.

As far as the paperless issue, were you receiving paper statements? I dont see any coorelation to that being an issue as it has nothing to do with the transaction download.

Have you spoke with citi ref this issue? Just asking.

There may be an issue with the file, have you tried validating the data file yet? - edited May 2018Thanks -- yes, was receiving paper, and want to continue. I don't think that's the issue any more. It's simply what caused the download to fail the first time, but it should have nothing to do with being able to reenable downloads now that I've confirmed I want to continue. I don't believe that Quicken Mac has a file-validate function, and Citi tech support is hopeless.

- edited May 2018Sorry, I don't have Q Mac software on my IPad but there are others in here that know more about Mac ware than I.

- edited July 2018Hello All,

Thank you for taking the time to report this issue and I apologize for any frustration or inconvenience this has or may further cause. We are currently investigating reports of receiving a CC-502 error code, OL-295-A in Quicken for Windows and a HTTP 403 error code, ccscrape.102 error or OL-295-A error in Quicken for Mac when attempting to add accounts or download transactions.

Please contact Quicken Support and reference Alert A-0255. The Support Agent will need to review your log files and possibly escalate this issue to our service providers for resolution.

Thank you,

Sarah - edited May 2018

Sarah, is the issue affecting all FIs or just Citibank?Hello All,

Thank you for taking the time to report this issue and I apologize for any frustration or inconvenience this has or may further cause. We are currently investigating reports of receiving a CC-502 error code, OL-295-A in Quicken for Windows and a HTTP 403 error code, ccscrape.102 error or OL-295-A error in Quicken for Mac when attempting to add accounts or download transactions.

Please contact Quicken Support and reference Alert A-0255. The Support Agent will need to review your log files and possibly escalate this issue to our service providers for resolution.

Thank you,

SarahQuicken user since Q1999. Currently using QW2017.

Questions? Check out the Quicken Windows FAQ list - edited May 2018

Hi mshiggins,Hello All,

Thank you for taking the time to report this issue and I apologize for any frustration or inconvenience this has or may further cause. We are currently investigating reports of receiving a CC-502 error code, OL-295-A in Quicken for Windows and a HTTP 403 error code, ccscrape.102 error or OL-295-A error in Quicken for Mac when attempting to add accounts or download transactions.

Please contact Quicken Support and reference Alert A-0255. The Support Agent will need to review your log files and possibly escalate this issue to our service providers for resolution.

Thank you,

Sarah

Currently we have open issues for Citibank and Chase that we are investigating but these issues are not affecting all FI's.

Thanks!

Sarah - edited May 2018

Hi Sarah,Hello All,

Thank you for taking the time to report this issue and I apologize for any frustration or inconvenience this has or may further cause. We are currently investigating reports of receiving a CC-502 error code, OL-295-A in Quicken for Windows and a HTTP 403 error code, ccscrape.102 error or OL-295-A error in Quicken for Mac when attempting to add accounts or download transactions.

Please contact Quicken Support and reference Alert A-0255. The Support Agent will need to review your log files and possibly escalate this issue to our service providers for resolution.

Thank you,

Sarah

Chase is working for me. Citi Cards is not. Error HTTP 403 trying to Direct Connect to Citi Cards. If disable downloads and try to reconnect, get 'Quicken cannot communicate with Citi Cards'.

I forwarded my log files to your email.Quicken Mac Subscription; Quicken Mac user since the early 90s - edited May 2018

Same for me. Chase is fine. Citi Cards does not connect with the same error message as RickO.Hello All,

Thank you for taking the time to report this issue and I apologize for any frustration or inconvenience this has or may further cause. We are currently investigating reports of receiving a CC-502 error code, OL-295-A in Quicken for Windows and a HTTP 403 error code, ccscrape.102 error or OL-295-A error in Quicken for Mac when attempting to add accounts or download transactions.

Please contact Quicken Support and reference Alert A-0255. The Support Agent will need to review your log files and possibly escalate this issue to our service providers for resolution.

Thank you,

Sarah - edited May 2018

After the usual deactivate and try to reactivate via the support agent, the final answer was wait 24 hours and try to connect again.Hello All,

Thank you for taking the time to report this issue and I apologize for any frustration or inconvenience this has or may further cause. We are currently investigating reports of receiving a CC-502 error code, OL-295-A in Quicken for Windows and a HTTP 403 error code, ccscrape.102 error or OL-295-A error in Quicken for Mac when attempting to add accounts or download transactions.

Please contact Quicken Support and reference Alert A-0255. The Support Agent will need to review your log files and possibly escalate this issue to our service providers for resolution.

Thank you,

Sarah

If not, then try again in 48 hours.

Wow. - edited May 2018Quicken indicated an HTTP 403 error with Citi, then a spinning circle while it downloaded over 500 duplicate transactions.

- edited May 2018

Fred, which connection method (Quicken Connect or Direct Connect)? And which Citi FI name, 'Citi Cards' or one of the others?Quicken indicated an HTTP 403 error with Citi, then a spinning circle while it downloaded over 500 duplicate transactions.

Quicken Mac Subscription; Quicken Mac user since the early 90s - edited May 2018

Hi Lucille,Hello All,

Thank you for taking the time to report this issue and I apologize for any frustration or inconvenience this has or may further cause. We are currently investigating reports of receiving a CC-502 error code, OL-295-A in Quicken for Windows and a HTTP 403 error code, ccscrape.102 error or OL-295-A error in Quicken for Mac when attempting to add accounts or download transactions.

Please contact Quicken Support and reference Alert A-0255. The Support Agent will need to review your log files and possibly escalate this issue to our service providers for resolution.

Thank you,

Sarah

This error has been escalated to our service providers for further investigation and resolution. As soon as an update on this issue is received, I will be back to share the details.

Thank you,

Sarah - edited May 2018

I am having the same problem with Citi Card. Error HTTP 403 trying to Direct Connect to Citi Cards. I disabled downloads but can't reconnect. I get 'Quicken cannot communicate with Citi Cards'. It's been going on for two days.Hello All,

Thank you for taking the time to report this issue and I apologize for any frustration or inconvenience this has or may further cause. We are currently investigating reports of receiving a CC-502 error code, OL-295-A in Quicken for Windows and a HTTP 403 error code, ccscrape.102 error or OL-295-A error in Quicken for Mac when attempting to add accounts or download transactions.

Please contact Quicken Support and reference Alert A-0255. The Support Agent will need to review your log files and possibly escalate this issue to our service providers for resolution.

Thank you,

Sarah - edited May 2018

I am having the same problem with Citi (Citi Cards).. I contacted them and they were no help. I am trying to use direct connect and it worked fine until two days ago.Hello All,

Thank you for taking the time to report this issue and I apologize for any frustration or inconvenience this has or may further cause. We are currently investigating reports of receiving a CC-502 error code, OL-295-A in Quicken for Windows and a HTTP 403 error code, ccscrape.102 error or OL-295-A error in Quicken for Mac when attempting to add accounts or download transactions.

Please contact Quicken Support and reference Alert A-0255. The Support Agent will need to review your log files and possibly escalate this issue to our service providers for resolution.

Thank you,

Sarah

What is the status with this? - edited May 2018

I have same problem . Direct Connect and 'Citi Cards'.. however I have not been able to download any so as of now I don't have and duplicates..Quicken indicated an HTTP 403 error with Citi, then a spinning circle while it downloaded over 500 duplicate transactions.

Here is what I see in the logs:

2018-05-25 12:48:20 +0000: HTTP error 403 from server:<HTML><HEAD>

<TITLE>Access Denied</TITLE>

</HEAD><BODY>

<H1>Access Denied</H1>

You don't have permission to access

Also, don't have any issue logging on to their website, but I was ask to change my password.. - edited January 2019This reply was created from a merged topic originally titled Citibank Credit Card.

Greetings,

Does anyone know if either Citibank or Quicken stopped supporting direct connect connection type? Since the most recent update, I can no longer download transactions from Citibank Credit Card. After continuing to receive an error message for the past few days, I switched to quicken connect connection type.

The error messaged that I received while attempting to utilize direct connect is --Oops. We're having a problem. Quicken cannot communicate with Citi Cards. HTTP 403

I am using Quicken Mac Deluxe 2018

Version 5.6.1 (Build 56.22375.100)

macOS 10.13.4 - edited December 2018This reply was created from a merged topic originally titled Citi Cards.

The direct Connect for Quickbooks is not working and after a conference call between Quickbooks tech support Citi and myself (and a very rude Citi individual at that) it is clear that Citi knows about the problem but they are in NO hurry to fix it. I am not sure about Quicken. I do not use that card very often I might test it now to see if it is the same. As a result I am closing my Citi Credit Card accounts. They have been very difficult to work with over the years and this was the last straw..

I am using both Quicken and Quickbooks in Windows but I would assume that this situation applies to the MAC version as well..

Note: This conversation was created from a reply on: Citibank Credit Card. - edited May 2018I am using Direct Connect with Citi Cards and have for years. Unlike others, I do get the HTTP 403 error, but 15 seconds later I get the pinwheel and a download of hundreds of duplicate transactions from the past few months.

- edited May 2018This reply was created from a merged topic originally titled AGGREGATOR_IN_ERROR error for Citibank.

I haven't been able to connect to my Citibank accounts for the past few days. Anyone else having this problem? Running Quicken for Mac Deluxe 2018 5.6.1 - edited May 2018This reply was created from a merged topic originally titled Merging.

yes, I'm having same problem. Getting cc-502 error. Have not been able to download for about a week now.

Note: This conversation was created from a reply on: AGGREGATOR_IN_ERROR error for Citibank. - edited May 2018This reply was created from a merged topic originally titled Merging.

Have the same problem this morning. This is the message box I got when updating:

And then this:

So..apparently something is up. And not in a good way.

Deactivated the account from downloads..and then couldn't re-connect them again to CitiCards via Direct Connect.

Note: This conversation was created from a reply on: AGGREGATOR_IN_ERROR error for Citibank. - edited May 2018This reply was created from a merged topic originally titled Merging.

Same here. FI = Citi Cards. Last connected successfully on Monday 5/21. QM 5.6.1.

Error HTTP 403 also.

On deactivating downloads and trying to reconnect, get 'Quicken cannot connect with Citi Cards'.

Note: This conversation was created from a reply on: AGGREGATOR_IN_ERROR error for Citibank.Quicken Mac Subscription; Quicken Mac user since the early 90s - edited May 2018This reply was created from a merged topic originally titled Merging.

Confirmed here, Mac, Quicken 18 Version 5.6.1 (Build 56.22375.100). May have started after latest minor update two days ago. Wonder if there's a way to go back a version.

Note: This conversation was created from a reply on: AGGREGATOR_IN_ERROR error for Citibank. - edited May 2018This reply was created from a merged topic originally titled Merging.

Bob, It's not the version. Same behavior in 5.5.7. Just a coincidence.

Note: This conversation was created from a reply on: Merging.Quicken Mac Subscription; Quicken Mac user since the early 90s - edited January 2019This reply was created from a merged topic originally titled ol-295-a error for citi card download this morning. is anyone else getting this..

Was able to download citi card transactions last night. This morning getting ol-295-a.

Hope it's temporary but was wondering if others are getting this error.0 - edited May 2018This reply was created from a merged topic originally titled Merging.

Yes I have the same problem error OL-295-A with Citi credit card

Quicken 2018 Deluxe , Windows 10

Note: This conversation was created from a reply on: ol-295-a error for citi card download this morning. is anyone else getting this.. - edited January 2019This reply was created from a merged topic originally titled Merging.

Yes, but according to the message, the bank's servers are temporarily not accepting requests, try again later, so I will.

Note: This conversation was created from a reply on: ol-295-a error for citi card download this morning. is anyone else getting this..0 - edited May 2018This reply was created from a merged topic originally titled Merging.

I'm having the same issue.

Note: This conversation was created from a reply on: ol-295-a error for citi card download this morning. is anyone else getting this.. - edited May 2018This reply was created from a merged topic originally titled Merging.

Same issue here.

Note: This conversation was created from a reply on: ol-295-a error for citi card download this morning. is anyone else getting this.. - edited January 2019This reply was created from a merged topic originally titled Merging.

I called Citi and they said there was no problem on their end. They had me deactivate and reactivate online access and Citibank connection was reestablished but it pulled in a lot of old transactions that I had to delete. It's working again. As a test, I tried restoring a Quicken backup from a day ago to avoid having to delete the downloaded transactions and the error reappeared. Something got changed with the connection to Citibank. So I restored the most recent backup, deleted to the old downloaded transactions and retried the connection. It worked. Strange.

Maybe just waiting a day would fix the problem.

Note: This conversation was created from a reply on: ol-295-a error for citi card download this morning. is anyone else getting this..0

QuickBooks for Mac is an accounting software specifically designed for business owners who use Mac computers. You can purchase QuickBooks for Mac for a one-time fee of $299.99 and use it to track of all your business finances.

QuickBooks for Mac is packed with features to help you organize your income and expenses. You can pay bills, invoice customers, track inventory, and track and pay 1099 contractors. You will also have access to detailed reports to make tax time a breeze. Get your business up and running on QuickBooks for Mac 2019 and save up to 40% for a limited time.

How QuickBooks for Mac Works

QuickBooks for Mac is very similar to QuickBooks for PC in terms of how it works. After you purchase the software, it must be installed on your computer before you can use it. Once installed, you will need to provide some details about your business and have a few documents handy to get your business set up properly.

Listed below is a checklist of what you will need to set up a new company in QuickBooks for Mac:

|

|

Once you have completed the setup process, you are ready to track all your business finances in QuickBooks for Mac. You can download the QuickBooks Set Up Checklist to your computer.

Listed below are six day-to-day tasks you can complete in QuickBooks for Mac.

1. Track Sales & Income

You can record a sale from services or products in QuickBooks for Mac by creating a sales receipt or an invoice. If your customer pays you at the time that you provide the goods or service, create a sales receipt. However, if your customer prefers to be billed, you will create an invoice instead. Both sales forms can be emailed to your customer directly from QuickBooks so that you don’t have to print and mail them.

2. Track Bills & Expenses

Similar to QuickBooks Online, there are several ways to keep track of your bills and expenses in QuickBooks for Mac. You can download your transactions, enter bills manually, or import expenses from a spreadsheet.

Listed below are three common ways to stay on top of your expenses:

- Connect your bank and credit card accounts so that transactions automatically download into QuickBooks for Mac

- Manually enter all vendor bills and print checks directly from QuickBooks for Mac

- Import billing details from an Excel spreadsheet into QuickBooks for Mac

3. Track Inventory

QuickBooks for Mac will keep track of all product purchases and sales. This means that you can create a purchase order and send it to your supplier. When the goods arrive, you can mark them as received against the original purchase order.

As you sell items in inventory, QuickBooks will automatically reduce your quantity on hand. In addition, when you reach the minimum order quantity, you will receive an alert to remind you to place an order. Several detailed reports are available for you to run and gain insight into your purchases and sales by product, customer, and many other options.

4. Run Payroll

If you have employees, you can turn on the Intuit Payroll services from within QuickBooks for Mac. Payroll processing in QuickBooks for Mac starts at $29 per month and includes:

- Payroll check calculations

- Pay via check or direct deposit

- W-2s for employees

- Payroll tax forms and filing

5. Accept Online Payments

Similar to QuickBooks Online, you can accept online payments from your customers with QuickBooks for Mac. When you enable the Intuit Payments feature, it will put a “Pay Now” button on all invoices that you email to customers. They can pay the invoice right away using a debit card or credit card or enter their bank account information. Turning this feature on requires you to click a button or two. There are two plans to choose from when you sign up for Intuit Payments.

Below is a summary of the Intuit Payment pricing plans for QuickBooks for Mac:

| Payment Type | ||

|---|---|---|

| Bank Transfer (ACH) | ||

| Card - Swiped | ||

| Card - Invoiced | ||

| Card - Keyed |

6. Run Key Reports to Gain Insights into Your Business

Similar to QuickBooks Online, QuickBooks for Mac has several detailed reports that you can run to gain key insights into how your business is doing. The reports available include but are not limited to profit and loss, balance sheet and statement of cash flows. Check out our guide on SMB Bookkeeping, Accounting, and Taxes to learn more about these reports.

Who QuickBooks for Mac Is Right For

The QuickBooks for Mac software is only compatible for computers with an iOS operating system. If you use a PC, then QuickBooks for Mac will not work for you. Head over to the Alternatives for QuickBooks for Mac section of this article to learn more about your options.

Business owners that use a Mac computer should use QuickBooks for Mac if they:

- Don’t need access to data while away from the office

- Don’t have more than three users that need simultaneous access

- Don’t need to connect their bank card or credit card accounts to QuickBooks for Mac

Unlike QuickBooks Online, QuickBooks for Mac is only accessible on the computer that you installed the software on. This means that you won’t be able to access the data while away from the office unless you sign up with a hosting service like Right Networks.

You can have a maximum of three users in your QuickBooks file at the same time, and you cannot connect your bank cards and credit card accounts to QuickBooks for Mac. This means that you will need to manually enter this data or import it from an Excel spreadsheet.

QuickBooks for Mac Costs

QuickBooks for Mac starts at a one-time fee of $299.95. As previously discussed, you can add payroll processing and payment services at any time for an additional fee. Unlimited tech support is included for the first 30 days. At the end of the 30 days, you will need to purchase a service plan to contact tech support for assistance.

QuickBooks for Mac Features

When it comes to features included, QuickBooks for Mac is packed with features that go well beyond the basics of tracking income and expenses for your business. In addition to tracking accounts payable, accounts receivable (A/R), inventory, payroll, accepting online payments, and having the ability to run detailed reports, we have included a list of additional features included.

Below are 12 additional features you will find in QuickBooks for Mac, including the new 2019 features.

1. Batch Invoicing

With batch invoicing, you can save a lot of time by completing one invoice and sending it to a group of customers. This is ideal if you sell the same products and/or services to a number of customers at the same time.

Example: Let’s say you are a real estate investor, and you own several buildings with tenants that pay monthly rent. If we assume that you have ten tenants that pay $1,000 a month for rent, you can create one invoice and send it to all 10 tenants at the same time.

2. Customized Chart of Accounts

Like most QuickBooks products, when you go through the initial company setup, QuickBooks will create a chart of accounts for you based on the industry that you selected. You can customize this list further by adding additional accounts that you need to track your income and expenses. You can remove accounts that you don’t need.

Example: Let’s say that you are a web designer, and you want to keep track of your initial consultation fee separate from the income you earn for the actual web design work. You can create an account called “Initial Design Consultation Fee” to keep track of this separately.

3. Custom Products & Services List

To keep track of all income earned from the products and services that you sell, you need to add these items to your products and services list in QuickBooks for Mac. App that reads for you mac.

Example: Using our example above for Initial Design Consultation Fee, you can set this up as an item on your products and services list. This makes it easy to bill customers because you can select it from the drop-down list when you create your invoices.

4. Track Multiple Locations & Departments

If you need to track income and expenses for multiple locations or departments, you can do this in QuickBooks for Mac. The feature that you will turn on is called class tracking. Once you set up all your locations and/or departments, you can tag all income and expenses with the appropriate “class.”

Example: Going back to our real estate investor that owns several buildings. The owner would like to track each building as a separate class so that he can run profit and loss reports to see how profitable each location is. He would set up each building as a class and then going forward tag all income and expenses to the appropriate class like building.

5. Budgeting & Forecasting

QuickBooks for Mac includes a robust budgeting and forecasting tool that allows you to create annual budgets for all income and expenses. In addition, you could create a budget for a specific customer or job and then run budget vs. actual reports periodically to check your progress.

Budgets can be created from scratch or QuickBooks will populate the previous year’s actuals as a starting point, and then you can make any necessary adjustments for the current budget year.

6. 1099 Tracking

If you hire independent contractors, you can track payments made in QuickBooks for Mac easily. At the end of the year, you can also generate the information that you need to provide the 1099 forms and reports that must be provided to the contractor and your local tax authority.

7. Multi-user Access

QuickBooks for Mac allows you to give up to three users access to your QuickBooks data. As the business owner, you will be the admin user, and you will be able to purchase up to two additional licenses to give access to your bookkeeper, certified public accountant, or tax professional. Keep in mind that the data is only accessible from the computer or network server where you installed the software.

8. iCloud Document Sharing

iCloud document sharing is a new feature that you will find in the new QuickBooks for Mac 2019 version. This feature allows you to move QuickBooks files from one Mac to another. You can share files between multiple Macs connected through iCloud.

9. Reconciliation Discrepancy Report

The reconciliation discrepancy report is also a new feature that you will find in the new QuickBooks for Mac 2019 version. In the past, this feature was only available in QuickBooks Desktop for PC and QuickBooks Online Accountant. It allows you to troubleshoot any issues that you have with reconciling your bank and credit card accounts each month.

An example of the reconciliation discrepancy report is below:

Reconciliation Discrepancy report from QuickBooks for Mac.

10. Email Tracking for Customers and Vendors

QuickBooks allows you to send emails to customers with estimates, invoices, and other documents attached. In addition, you can also email purchase orders and other documents to vendor suppliers. This new feature that has been added to QuickBooks for Mac 2019 tracks all emails sent to vendors and customers so that you can review this data any time.

11. Past Due Stamp on Invoices

With the 2019 QuickBooks for Mac version, customer invoices that are delinquent will now have a “Past Due” stamp on them in QuickBooks so that you can see easily which invoices are outstanding. If you email the invoice to the customer after the due date, he or she will also see the “Past Due” stamp, which should prompt your customer to make a payment. See an example of this below:

Past Due stamp on delinquent Invoices in QuickBooks for Mac.

12. Square Transactions Import

The last new feature that was added to QuickBooks for Mac 2019 is the ability to import your sales data from Square into QuickBooks for Mac. This will save you a ton of time because you won’t have to enter the data manually any longer. See an example of how this works below:

Quickbooks For Mac Can't Download Transactions To Credit Card 2016

Pros & Cons of QuickBooks for Mac

Like with most software products there are pros and cons to using QuickBooks for Mac. While it is user-friendly, packed with features, and easy to find help when you need it; it is not accessible easily and is limited when it comes to QuickBooks Online support and the number of users to whom you can give access.

Pros of QuickBooks for Mac

There are several positives to using QuickBooks for Mac. Like the PC version, it has a user-friendly interface, it includes several robust features at an affordable price, and it’s easy to find an expert if you need help.

Below are three pros of using QuickBooks for Mac:

- User-friendly: Like most QuickBooks products, QuickBooks for Mac is easy to set up and navigate if you don’t have a bookkeeping or accounting background

- More features for cost: QuickBooks for Mac includes many features at an affordable one time cost of $299.99; A/R, accounts payable (A/P), inventory tracking, and 1099 reporting are some of the features included in QuickBooks for Mac

- Get help when you need it: If you need help setting up your business or you have questions, you can find a bookkeeper or accountant who is familiar with QuickBooks for Mac; be sure to check out our How to Find QuickBooks ProAdvisors guide to learn how to find a QuickBooks for Mac expert in your local area

Cons of QuickBooks for Mac

Most of the drawbacks of QuickBooks for Mac are centered on the fact that it is a desktop product that requires you to install software. As a result, there are limitations when it comes to accessibility, QuickBooks Online support and number of users.

Below are three negatives of using QuickBooks for Mac:

- No mobile access to data: Unlike QuickBooks Online which allows you to access your data from any computer with an internet connection, QuickBooks for Mac can only be accessed from the computer where the software was installed; as discussed previously, you can sign up for a hosting plan to access your data away from the office

- Limited tech support: When you purchase QuickBooks for Mac, it comes with unlimited tech support for the first 30 days; afterward, you must purchase a support plan to get help or hire a QuickBooks expert

- Maximum of three user licenses: QuickBooks for Mac comes with one user license’ you can purchase up to two additional licenses if you need to give other users access to your data

Alternatives to QuickBooks for Mac

QuickBooks Online for Mac is an ideal alternative to QuickBooks for Mac Desktop. QuickBooks Online is cloud-based accounting software that can be used on any desktop computer, laptop, tablet, or cellphone. Unlike QuickBooks for Mac Desktop, there is no software to install. You need a device that can connect to the internet and you can access your data easily by logging in with a secure ID and password.

There is a glance at the three QuickBooks Online for Mac pricing plans:

- QuickBooks Online Simple Start: Costs $20 per month; ideal for startup businesses; save up to 50% here

- QuickBooks Online Essentials: Costs $35 per month; best for small to medium-sized businesses that sell services only; save up to 50% here

- QuickBooks Online Plus: Costs $60 per month; best for any business that sells products or services; save up to 50% here

Below is a summarized feature comparison chart of QuickBooks for Mac vs. QuickBooks Online pricing plans.

QuickBooks for Mac vs. QuickBooks Online for Mac Feature Comparison at a Glance

QuickBooks Online Simple Start

QuickBooks Online Simple Start is ideal for startups that pay their bills with a debit card, credit card, or through an automated clearing house (ACH). This plan is the most economical out of the three plans at $20 per month. However, it is limited when it comes to features included. While you can manage A/R, connect your bank card or credit card accounts and give access to one user and two accountants, QuickBooks Online Simple Start does not include the following features:

- Ability to manage A/P

- Ability to track inventory

- Track payments to contractors & prepare 1099s

- Create & manage budgets

QuickBooks Online Essentials

QuickBooks Online Essentials is right for small to medium-sized businesses that sell services only. This plan is the mid-tier plan and will cost $35 per month. In addition to the features included in the Simple Start plan, it includes the following features:

- Ability to manage A/P

- Ability to give access to three users plus two accountants vs. one user and two accountants in the Simple Start plan

QuickBooks Online Plus

QuickBooks Online Plus is ideal for small to medium-sized businesses that sell products and services. This plan is $60 per month, three times the Simple Start plan ($20 per month) and $25 per month more than the Essentials plan. However, you do get several additional features for the hefty price tag:

- Ability to give access to five users and two accountants for a total of seven users vs. five with the Essentials plan and three in Simple Start

- Able to track inventory

- Track payments and prepare 1099s for independent contractors

- Create & manage budgets

QuickBooks Online Plus is the plan that comes closest to including all the features that you will find in QuickBooks for Mac Desktop. The primary difference between the two plans is all QuickBooks Online plans included unlimited QuickBooks Online support vs. free tech support for the first 30 days with QuickBooks Mac.

For support beyond 30 days, you will need to purchase a support plan. In addition, QuickBooks Online Plus includes up to seven users, and QuickBooks Mac comes with one user license, and you can purchase up to two additional licenses.

If you are a current QuickBooks for small business Mac user who is considering switching to QuickBooks Online, check out our guide on converting from QuickBooks Desktop to QuickBooks Online.

QuickBooks for Mac Reviews

QuickBooks for Mac users who gave a positive review like the robust features and the easy to use interface. However, users who gave a negative review said that QuickBooks for Mac doesn’t quite have all the bells and whistles that QuickBooks Desktop for the PC has. Be sure to check out our QuickBooks for Mac reviews page for more information.

QuickBooks for Mac Frequently Asked Questions (FAQs)

Listed below are the most frequently asked questions about QuickBooks for Mac.

Is there a Mac Version of QuickBooks?

There is a Mac version of QuickBooks, and the latest edition is QuickBooks for Mac 2019. You can purchase QuickBooks for Mac for $299.99 and install the software on your Mac computer. Similar to the PC version of QuickBooks, you can track all your business income and expenses in QuickBooks for Mac.

Is QuickBooks for Mac Discontinued?

Last year, Intuit announced that it was discontinuing QuickBooks for Mac and would support the 2016 version through May 31, 2019. However, due to feedback from several QuickBooks customers who use QuickBooks for Mac, Intuit renewed its commitment to these customers by releasing QuickBooks for Mac 2019.

What’s the Difference Between QuickBooks for Mac and QuickBooks Online?

There are several differences between QuickBooks for Mac and QuickBooks Online. QuickBooks for Mac was designed for Mac users and must be installed on a Mac computer whereas QuickBooks Online is a cloud accounting software that doesn’t require installation and can be used on a PC, Mac or any mobile device with an internet connection.

Check out our QuickBooks comparison chart for a detailed breakdown of the differences between QuickBooks for Mac and QuickBooks Online.

Quickbooks For Mac Can't Download Transactions To Credit Card Account

What’s the Difference Between QuickBooks for Mac and QuickBooks for PC?

There are several differences between QuickBooks for Mac and QuickBooks for PC. QuickBooks for Mac was designed specifically for Mac computers and QuickBooks for PC was designed for the PC. Both products have a starting price of $299.99 and include many of the same features such as the following:

- Track and pay bills

- Create and send invoices

- Track inventory

- Track and pay 1099 contractors

- Detailed reports such as profit and loss, balance sheet, and cash flow statement

Quickbooks For Mac Can't Download Transactions To Credit Card Free

The Bottom Line

Now that you know what QuickBooks for Mac is and how it works, it’s time for you to make a decision. If you need access to your data 24/7/365, choose QuickBooks Online for Mac. However, if you don’t need mobile access to your data, and you want an affordable way to manage your income and expenses, choose QuickBooks for Mac.

QuickBooks for Mac allows you to keep track of every financial aspect of your business. Create invoices or sales receipts to track income and write checks to pay your bills. With a few clicks, you can review sales and analyze how profitable your business is. QuickBooks offers a 60-day money back guarantee, so you’ve got nothing to lose. Download QuickBooks for Mac 2019 and get your business up and running in no time.